A retirement strategy is critical to make the best use of your hard-earned savings, so you can enjoy retirement by spending more time with your family and grandchildren, and perhaps travelling the world.

The period immediately before and after retirement is arguably the most important in a financial lifetime. Having spent many years earning and accumulating capital you are now approaching the decumulation period of using your savings to provide income and meet all your expenditures.

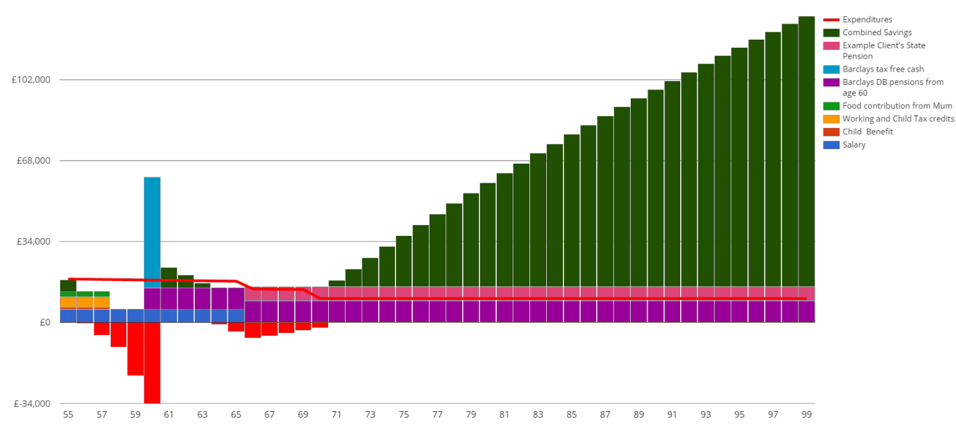

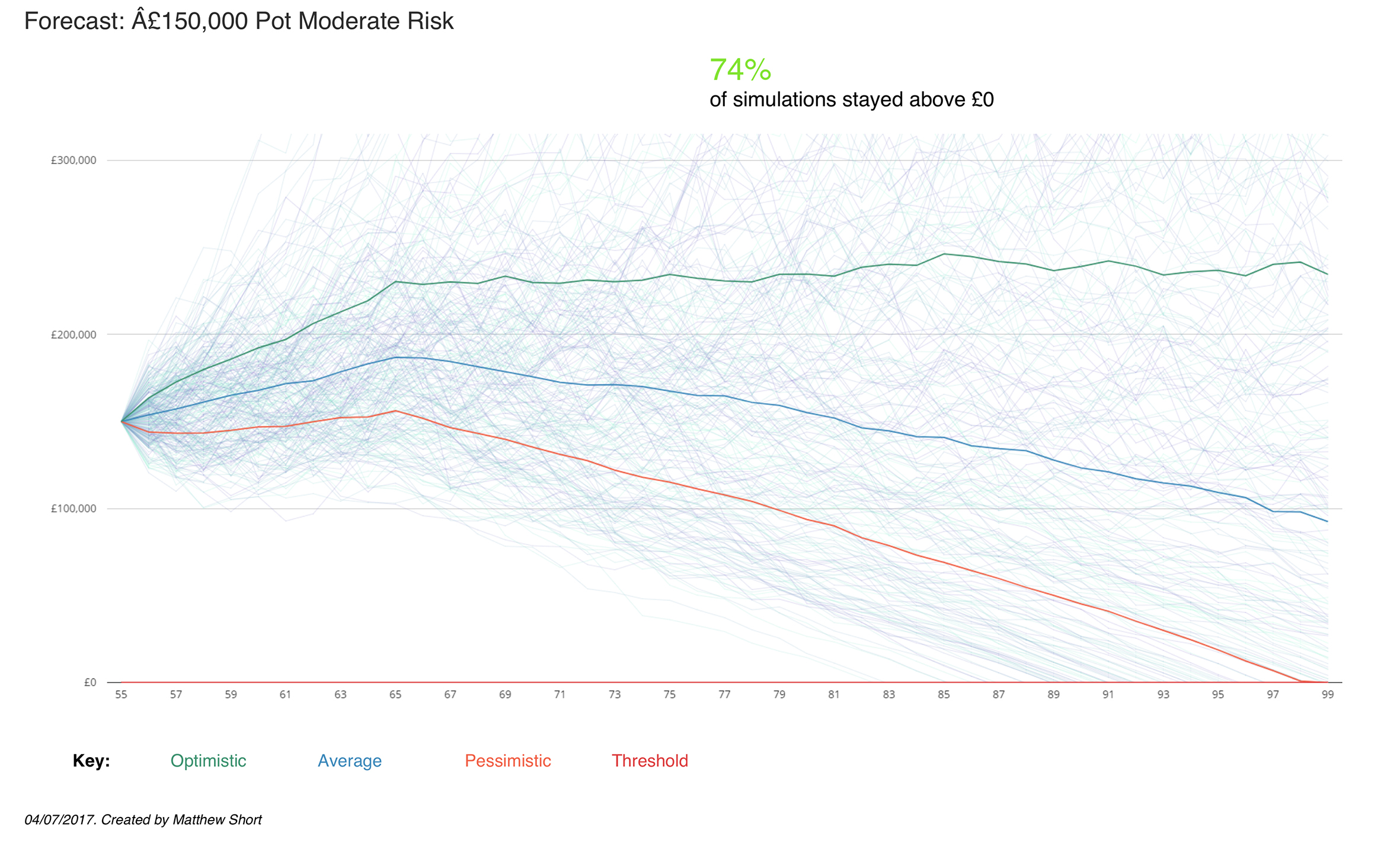

We design your retirement income using strategies such as annuity, drawdown and phased retirement which are considered alongside your savings, your property and any business shareholdings. We then carefully combine and balance these to ensure an optimum and tax efficient income.

Cashflow Planning and Retirement Monte Carlo simulations will further complement your financial plan.

Knowing how we improved some of our existing client’s financial lifestyles may help you understand what we can achieve for you:-

In transferring my pension from a final salary scheme to a SIPP, Douglas helped me make the most important investment decision of my life. His approach was thorough and objective and we quickly built a trusting relationship. There was never any pressure to proceed with the pension transfer, it was more about discussing the pros and cons so that I could make an informed decision that was right for me and my family. Douglas is very approachable and I have no hesitation in contacting him about any aspect of my financial affairs. In fact he is currently working with my wife to review and upgrade her Employee Benefits package.

"Meeting Douglas was a breath of fresh air after fruitlessly dealing with one of the biggest London based investments houses for over 12 months. Douglas made all the necessary arrangements in double quick time, moreover he made suggestions at the outset that the previous firm hadn’t even considered which benefited us hugely.

Douglas has been our contact from the outset. We have regular face to face meetings during which we review the portfolios performance and alternatives are discussed to make our plans a reality. We genuinely enjoy the meetings which are pitched just right ! The ongoing holistic advice has covered both the macro and the micro which together have made a significant difference to our families financial well-being.

We appreciate the ability to review the portfolios performance on a daily basis via Wealth Platform. The level of detail can be as little or as much as you choose to view. All ongoing charges are completely transparent on the platform.

Wealth Professional is a small friendly team that are a pleasure to work with and who quickly respond to requests. In summary I would have no hesitation in recommending them ."

I looked at a number of financial advisory firms before I settled on Wealth Professional, which was recommended by a colleague. As well as an objective review, personal interaction was a key factor for me; after all, this is going to be a long term relationship and I wanted to be comfortable with the personal relationship too. No fears there as Douglas Mitchell and I swiftly established a rapport and he remains firmly my trusted adviser. That trust was well earned; in the initial stages, we agreed milestones to reflect and consider actions and opportunities with Douglas regularly testing my appetite for risk. His review of my financial affairs bordered on forensic and he took time to consider my immediate and future needs. Post investment phase we meet regularly to make sure that my investment goals are met. I would have no hesitation in recommending Douglas and Wealth Professional CFP.

I have been a client of Medical & Professional for over 5 years and during this period the service and customer care have been excellent. Great attention to detail which is reassuring. The explanations I receive are clear, concise, and make financial services.